Optimize Your Manufacturing Finances

Power your manufacturing success with tailored finance solutions.

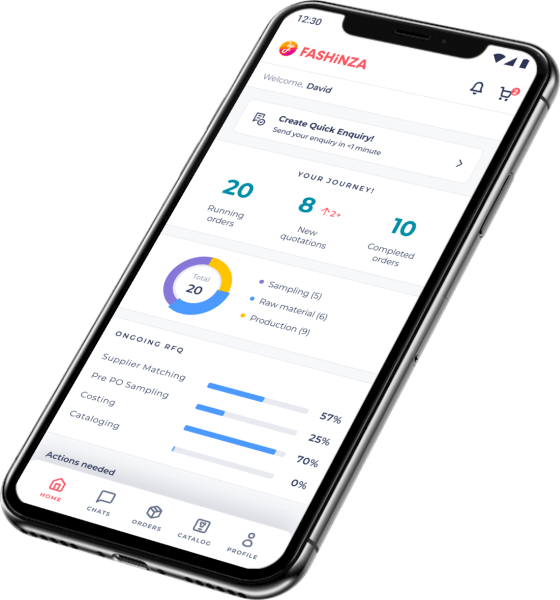

A One Stop Platform From Design To Delivery

We provide real-time tracking and updates through our state-of-the-art technology platform.

Never Miss a Beat

Get weekly email updates from Fashinza to your inbox

What our partners say about us

‘Very clear when it came to tracking the order’s progress’

Fashinza’s platform was very clear when it came to tracking the order’s progress. It was convenient as anytime I could check the current progress of the order. All my questions were answered professionally and in a timely manner by customer support. The shipment of samples I received was much appreciated and alleviated any worries regarding the quality of the finished goods!

Kristina Garrison,

Head of Purchasing

Finance that is Fun

Finance Made Fun and Fair

Finance made easier with Fashinza

Financing the right way

Frequently asked question

Q. How can manufacturing companies improve cash flow?

A. Manufacturing companies can improve cash flow by implementing strategies such as reducing inventory levels, negotiating better payment terms with suppliers and customers, and improving collections processes. It's also important to closely monitor cash flow and make adjustments as needed.

Q. What is manufacturing finance?

A. Manufacturing finance is the process of managing financial operations in the manufacturing industry. It involves managing costs, investments, cash flow, and other financial aspects of the manufacturing process.

Q. What are some key financial indicators in manufacturing?

A. Some key financial indicators in manufacturing include cost of goods sold (COGS), gross margin, operating expenses, net income, and return on investment (ROI). These metrics provide insight into the financial health of the manufacturing process and help identify areas for improvement.

Q. How can manufacturing companies reduce costs?

A. Manufacturing companies can reduce costs by identifying and eliminating waste, optimizing processes to increase efficiency, and negotiating better pricing with suppliers. It's also important to regularly review expenses and look for ways to reduce costs without sacrificing quality.

Q. What financing options are available for manufacturing companies?

A. Manufacturing companies have several financing options available, including traditional bank loans, lines of credit, equipment financing, and factoring. It's important to carefully consider the pros and cons of each option and choose the one that best fits the company's financial needs and goals.

Other articles in this category

How To Calculate Product CM at The Time of Order Booking?

|

The Ultimate Guide To Bill Of Materials In Fashion

|

How To Create A Garment Costing Sheet

|

How To Make A Bill Of Materials (BOM)?

|

How To Optimize Open To Buy Budget

|

Difference Between Purchase Requisition & Purchase Order; When & How to Use Both?

|

A Guide to the Purchase Order Number: Why It Matters, How to Create & Use It

|

Step-by-Step Purchase Order Process And Ways To Streamline It

|

Different Types of Purchase Orders Formats and How to Create Them